Our Success Stories

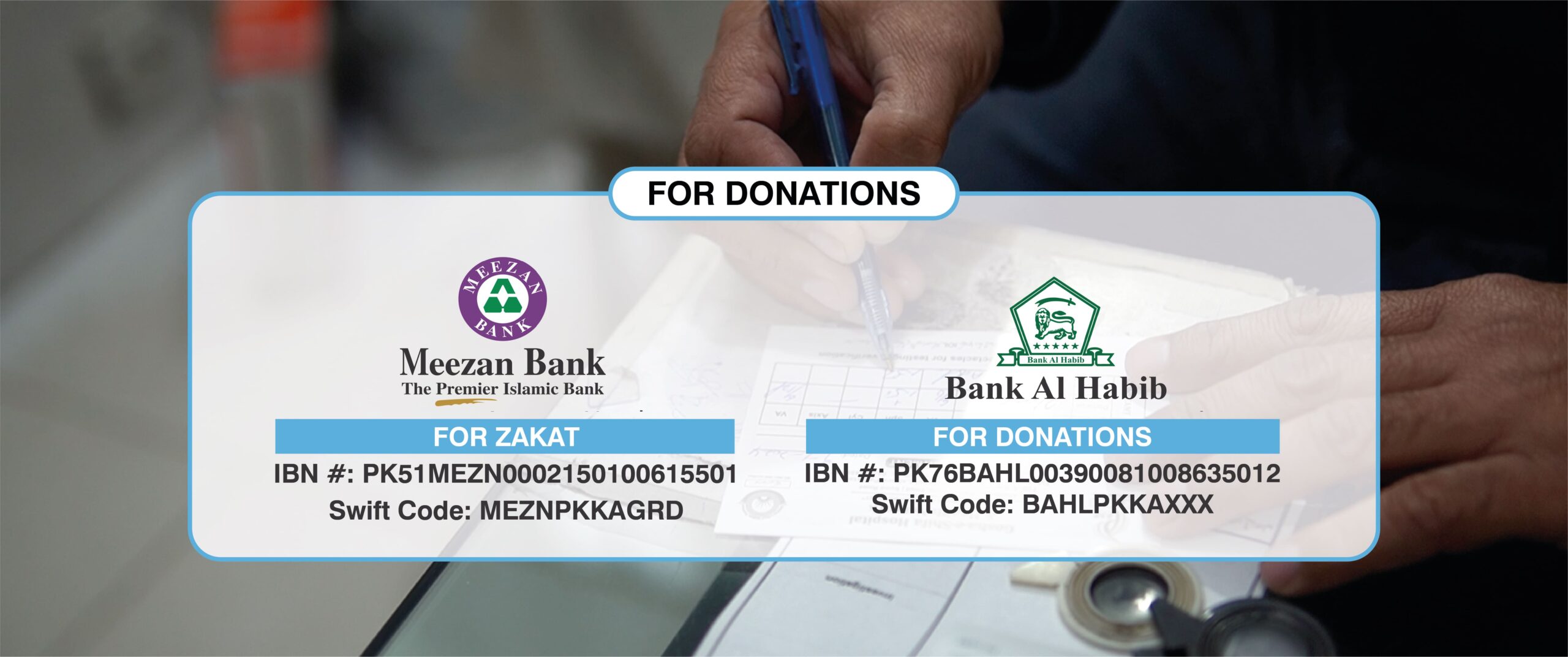

Looking forward for your Zakaat & Donations

Frequently Asked Questions

About Zakat

Zakat stands as the third pillar of Islam, embodying the obligation for Muslims to allocate a portion of their wealth to support the less fortunate. It is not just a financial duty but a profound act of worship, underscoring the responsibility of the affluent towards those facing hardship. The term “Zakat” translates to “purification,” reflecting the belief that this charitable contribution purifies one’s wealth and earns the pleasure of Allah SWT.

By fulfilling the obligation of Zakat, Muslims can significantly impact the lives of the needy, bringing about transformation and offering vital support to vulnerable individuals and communities.

Nisab serves as the threshold determining when Zakat becomes obligatory for Muslims, requiring them to allocate 2.5% of their total wealth to support those in need.

Originally established by Prophet Muhammad (PBUH), Nisab was set at 20 Mithqaal of gold or 200 dirhams of silver. This equates to approximately 87.48 grams (7.5 tola) of gold and 612.36 grams (52.5 tola) of silver, respectively.

It’s crucial to understand that if an individual possesses solely gold, the Nisab level for gold (87.48 grams) applies. However, if one’s assets include a combination of different resources (such as gold, silver, currency, etc.), the lower Nisab level for silver (equivalent to the current value of 612.36 grams of silver) should be utilized for calculation purposes.

Zakat serves as a divine connection, drawing believers closer to Allah SWT. As an obligatory act of charity, it serves to shield the impoverished from destitution, hunger, and financial insecurity. Beyond its direct aid to those in need, Zakat showers countless blessings upon its contributors. It purifies wealth, absolves minor transgressions, and cleanses the heart and soul from the grip of greed.

The Quran underscores this divine mercy, stating, “…but My mercy encompasses all things. I shall ordain My mercy for those who are conscious of God and pay the prescribed alms; who believe in Our Revelations.” (Quran 7:156) This verse emphasizes that while divine mercy encompasses all, it is specifically designated for the righteous who fulfill their obligation of Zakat.

The Quran in 9:60 delineates eight distinct categories of recipients of Zakat:

- The poor (Fuqara)

- The needy (Masakeen)

- Those appointed to administer Zakat (Al-‘Aamileen)

- Those whose hearts are inclined towards Islam and the Muslim community (Al-Mu’allafatu-Al-Quloob)

- The liberation of slaves (Ar-Riqaab)

- Individuals burdened by debt (Gharimeen)

- The cause of Allah SWT (fi Sabilillah)

- Travelers in need (Ibn-us-sabil)

These categories, ordained by Allah SWT, ensure that Zakat reaches a diverse array of individuals and causes, embodying divine wisdom and knowledge.

Zakat is obligatory for individuals who meet the following criteria:

- Muslim

- of age (Baligh)

- mentally sound (Sane)

- Possess wealth exceeding the Nisab threshold (Sahib-un-nisaab)

If all of these conditions are met, Zakat must be paid, amounting to 2.5% of one’s total savings and other applicable assets.

Zakat is not obligatory on every asset but specifically on those with the potential for growth or increase. These assets fall into several categories:

- Trading Assets

- Cash and Cash Equivalents (such as prize bonds, traveler’s checks, etc.)

- Gold and Silver (regardless of purpose)

- Livestock, including goats, sheep, cows, and camels (with a different Nisab)

- Agricultural output (known as Ushr)

Only the remaining balance of these assets at the end of the lunar year is subject to Zakat. There is no obligation to pay Zakat on the amount spent throughout the year.

Zakat obligation arises only after a complete lunar year has elapsed, provided that the qualifying wealth has been held for that duration. Your Zakat year commences from the date your wealth initially equaled or surpassed the Nisab threshold, and this date serves as the reference point for subsequent calculations each year.

While Zakat can be given at any time, numerous Muslims opt to fulfill their Zakat duty during the sacred month of Ramadan. This choice is motivated by the enhanced rewards and blessings associated with giving during this auspicious period, surpassing those of any other time of the year.